Navigating the crypto space is becoming increasingly complex, with thousands of new tokens, protocols, and dApps emerging daily. But what if an AI-powered assistant could handle everything for you – analyzing trends, executing trades, and optimizing investments automatically? Welcome to the era of Crypto AI agents. They are autonomous programs that leverage AI to execute tasks, optimize trading strategies, and enhance security in decentralized environments.

As AI continues to evolve, businesses are exploring how AI-driven crypto agents can help them automate trading, manage portfolios, and optimize blockchain-based applications. This article explores the rise of AI agents and how businesses can develop their own AI-driven trading solutions.

The rise of AI agents

In recent years, the AI agent sector within Web3 has experienced exponential growth. As of late 2024, the industry has surged to a valuation exceeding $16 billion, with some AI agents trading at valuations in the hundreds of millions. This rapid expansion underscores the increasing demand for intelligent automation in decentralized platforms.

AI agents are rapidly transforming Web3 by reducing manual effort, accelerating decision-making, and optimizing resource allocation. Web3 businesses are leveraging AI for code generation, contract audits, and security enhancements, making blockchain development faster and safer. AI-driven interfaces also simplify DeFi interactions, automated trading, and portfolio management, making them more accessible to a broader audience.

📌 Read more The benefits of AI Chatbots

Beyond finance, AI agents are reshaping other sectors. In gaming, they enhance gameplay, manage digital assets, and assist in Web3-based economies. In content creation and security, AI agents help detect fraud, manage risks, and automate digital workflows, strengthening blockchain infrastructure.

Categories of AI agents

Crypto AI agents can be categorized based on their primary function and use case. Below are the 3 major types of AI agents in the crypto space:

Prompt-based agents

Prompt-based AI agents engage users through text-based commands, providing valuable insights and answering crypto-related queries. These agents are often integrated into platforms like Telegram, Discord, and other Web3 chat tools. Their primary functionalities include:

- Market analysis: They assist traders by analyzing market trends, price movements, and providing data-driven insights to inform trading decisions.

- User interaction: By facilitating natural language conversations, these agents can guide users through complex crypto concepts, making it easier for newcomers to navigate the space.

- Decision support: They offer recommendations based on user inputs and current market conditions, helping users make informed choices.

Automated trade and portfolio management

Automated trade and portfolio management agents leverage machine learning algorithms to enhance trading efficiency and investment strategies. Key features include:

- Real-time data analysis: These agents continuously analyze market data, identifying profitable trading opportunities and executing trades on behalf of users.

- Risk mitigation: By evaluating market conditions and historical data, they can implement risk management strategies, such as setting stop-loss orders and diversifying portfolios.

These agents are particularly valuable for crypto hedge funds and retail investors seeking to automate their trading processes.

Gaming agents

AI-driven gaming agents play a crucial role in enhancing play-to-earn (P2E) models and metaverse ecosystems. They facilitate interactions within decentralized autonomous organizations (DAOs), empowering players to participate in governance decisions and community events.

- In-game transaction automation: These agents can automate transactions within games, streamlining processes like buying, selling, or trading in-game assets.

- NFT asset management: They help users manage their NFT collections, optimizing their value through strategic buying and selling.

- Reward optimization: By analyzing user behavior and game mechanics, these agents can optimize rewards, ensuring players receive the best possible returns on their in-game activities.

📌 You might be interested in Web3 Game Ecosystem

Top 5 crypto AI agents in 2025

Top 5 crypto AI agents in 2025

Virtuals Protocol (VIRTUAL)

Virtuals Protocol is a decentralized protocol on the Base Layer 2 chain, enabling users to create, deploy, and manage AI agents across different crypto applications. Its AI agents can execute smart contract interactions, monitor blockchain activities, and optimize DeFi strategies without manual intervention.

ai16z (AI16Z)

ai16z is a decentralized AI-powered trading fund operating on the Solana blockchain. It leverages AI agents and community governance through a Decentralized Autonomous Organization (DAO) to streamline the investment process. Notably, ai16z has rebranded to “ElizaOS” and is priced at around $0.4025, with a market capitalization of approximately $441 million.

Artificial Superintelligence Alliance (FET)

This AI agent network, backed by Fetch.ai, SingularityNET, and Ocean Protocol, aims to decentralize AI intelligence for blockchain applications. FET-powered AI agents enhance automated transactions, fraud detection, and data analysis across various industries.

aixbt by Virtuals (AIXBT)

AIXBT is an AI-driven market sentiment analysis tool that provides traders with real-time insights on crypto prices, news, and investor sentiment. It helps businesses predict market movements and optimize investment strategies.

Griffain (GRIFFAIN)

Griffain is an AI-powered decentralized assistant that enables users to automate crypto transactions, execute smart contracts, and manage NFT assets. It integrates multi-chain AI capabilities to enhance security and efficiency in blockchain applications.

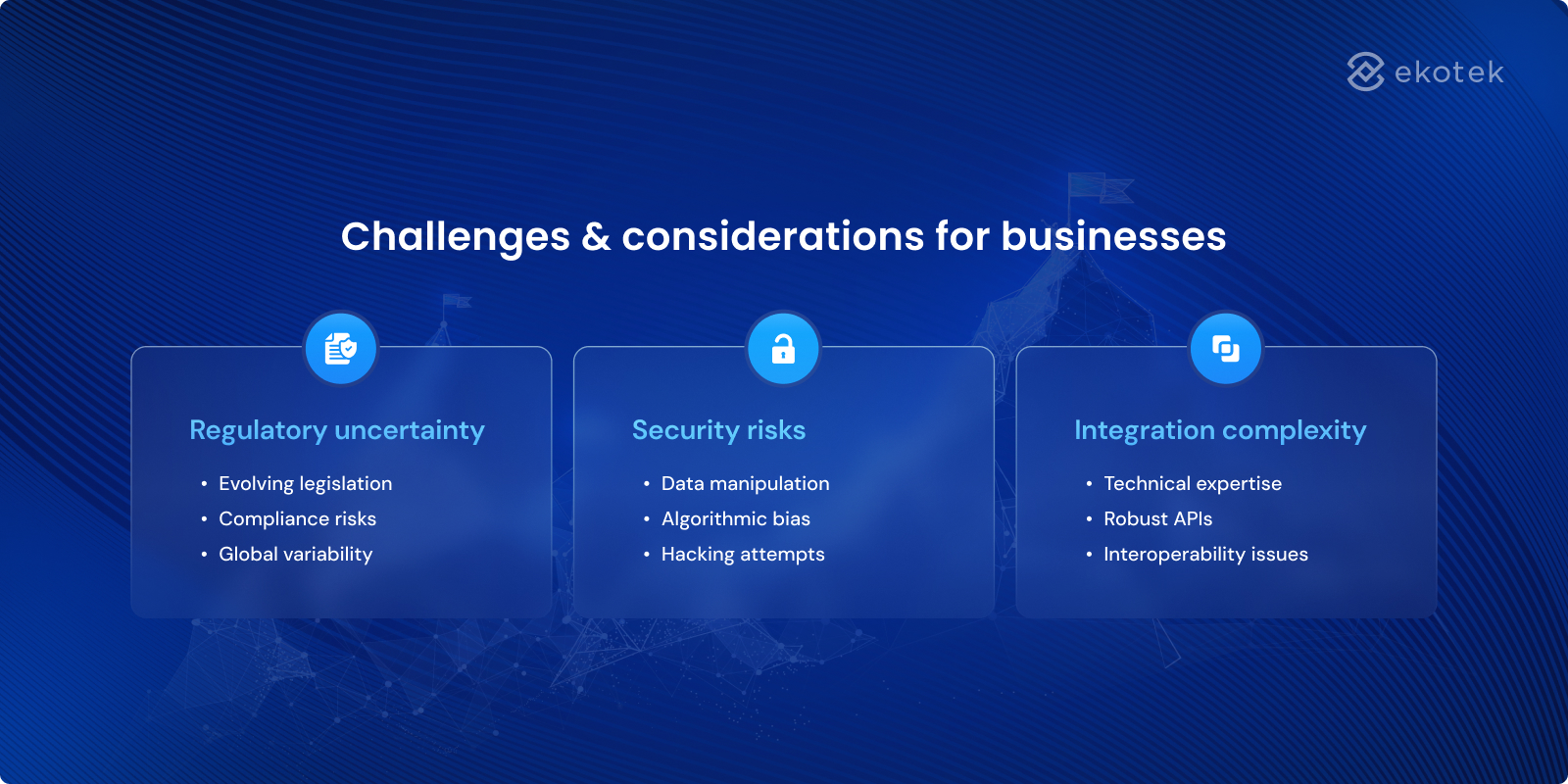

Challenges & considerations for businesses

While crypto AI agents present significant advantages, businesses must navigate several challenges to leverage their full potential effectively. Here’s a detailed analysis of these challenges:

Regulatory uncertainty

- Evolving legislation: Governments worldwide are still in the process of formulating comprehensive laws regarding AI technologies and cryptocurrency. This creates a landscape of regulatory uncertainty. Businesses should work with legal experts to ensure compliance with emerging regulations.

- Compliance risks: Businesses may face legal repercussions if they inadvertently violate emerging regulations. The lack of clear guidelines can lead to confusion about what is permissible, resulting in potential fines or sanctions.

- Global variability: Different jurisdictions may have conflicting regulations, complicating compliance for businesses operating internationally.

Security risks

- Data manipulation: AI models can be susceptible to adversarial attacks where malicious actors manipulate input data to produce incorrect outputs. This can undermine the integrity of trading decisions made by AI agents.

- Algorithmic bias: If the training data used to develop AI models is biased, the resulting outputs may reflect those biases, leading to unfair or flawed decision-making in trading and investment.

- Hacking attempts: AI agents can become targets for cyberattacks, posing risks to sensitive data and financial assets. Businesses may think of implementing AI model auditing and secure API integrations to mitigate hacking risks.

Integration complexity

- Technical expertise: Implementing AI agents requires specialized knowledge in both AI and blockchain technology. Businesses may struggle to find qualified personnel or outsourcing partners who can navigate these complex fields.

- Robust APIs: Seamless integration of AI agents with existing systems and blockchain platforms necessitates well-designed APIs. Poor integration can lead to operational inefficiencies and data silos.

- Interoperability issues: Different blockchain platforms may have varying protocols and standards, complicating the integration process and limiting the functionality of AI agents across multiple networks.

To mitigate these challenges, businesses should conduct thorough security audits, comply with emerging regulations, and partner with AI-driven blockchain service providers.

How to develop an AI agent for crypto trading

How to develop an AI agent for crypto trading

Define the use case

Before development begins, clearly define what your AI agent will do. Will it be used for automated trading, risk assessment, portfolio management, or liquidity optimization? Understanding the core functionality helps determine the right tools and strategies.

Choose your approach

Businesses must decide between 2 main approaches:

- Using pre-built AI tools: Leverage existing AI-powered crypto trading bots or platforms for faster deployment and lower development costs.

- Building a custom AI agent: This offers greater control, customization, and long-term scalability, allowing for unique features tailored to business needs.

Choose a development framework (for custom agents)

If opting for a custom AI agent, selecting the right development framework is crucial. Consider:

- Scalability: The framework should handle increasing volumes of transactions and users.

- Web3 compatibility: Ensure smooth integration with decentralized applications (dApps) and smart contracts.

- Blockchain integration: Choose frameworks that support interoperability across major blockchain networks like Ethereum, Solana, or BNB Chain.

- Popular choices: TensorFlow, PyTorch (for AI models), and Web3.js, ethers.js (for blockchain interaction).

In-house development vs. outsourcing

- In-house team: Offers more control and direct oversight but requires expertise in AI, blockchain, and security.

- Outsourcing: Faster and cost-effective, especially when leveraging specialized Web3 and AI development firms like Ekotek

Development

- Train the AI model on historical crypto data to enhance decision-making.

- Implement real-time data processing for market trend analysis.

- Integrate smart contract functionality for automated trade execution.

- Ensure robust security protocols to prevent exploits.

Launch and optimization

- Beta test: Deploy in a controlled environment to assess performance.

- Monitor & improve: Use AI feedback loops to enhance decision-making over time.

- Regulatory compliance: Ensure adherence to crypto trading regulations in relevant jurisdictions.

Final thoughts

Final thoughts

AI-driven crypto agents are transforming blockchain-based businesses by enhancing efficiency, security, and decision-making. As AI technology evolves, businesses must explore how to integrate AI agents into their operations to stay competitive in the digital economy. By developing custom AI-powered bots, businesses can optimize their blockchain activities and unlock new revenue opportunities.

Ekotek is a Clutch-verified software and blockchain development company. We don’t just build AI agents, we create scalable, future-proof AI solutions tailored for Web3. With deep industry know-how, our team understands the complexities of developing cutting-edge AI agents and Web3 applications. For businesses looking for a faster and cost-effective way to deploy AI-driven crypto solutions, we offer white-label solutions that are customizable, scalable, and ready for market. Our top white-label solutions include: crypto AI agent, ChatGPT integration, crypto launchpad, or NFT marketplace…

Interested in AI-powered crypto? Contact Ekotek today for expert consultation and tailored solutions.

Top 5 crypto AI agents in 2025

Top 5 crypto AI agents in 2025 How to develop an AI agent for crypto trading

How to develop an AI agent for crypto trading Final thoughts

Final thoughts