Introduction

In today’s market, business leaders face unprecedented pressure to keep pace with rising customer expectations and competitors rapidly embracing fintech-enabled platforms. Recent figures indicate the embedded finance for business market is projected to exceed $7 trillion in annual transaction value by 2026, underlining how crucial it has become for executive teams to rethink everything from customer journeys to monetization. As digital transformation accelerates, traditional approaches are struggling to deliver the speed and flexibility enterprises need, compelling leadership to explore smarter, platform-native solutions.

This guide is tailored for executives, managers, and tech leads who want to act—not just react. Inside, you’ll find practical frameworks, proven enterprise case studies, and tangible benefits, along with a step-by-step action plan for adopting embedded finance. This is not just about understanding the “what”; it’s about uncovering the “how” and “why now” with tools, checklists, and ready-to-implement strategies drawn from leading enterprises. By the end, you’ll have a blueprint to capture new revenue, embed finance seamlessly, and future-proof your business.

What Is Embedded Finance for Businesses?

Embedded finance is the ability for a business to offer financial services right inside its own product or platform, without sending users to a bank or another website.

In simple terms, it means:

-

A logistics platform can let drivers receive instant payouts.

-

An e-commerce site can offer buy-now-pay-later at checkout.

-

A SaaS platform can give customers a built-in digital wallet.

-

A marketplace can provide insurance during the purchase flow.

The business isn’t becoming a bank. Instead, it connects to licensed financial providers through APIs, and the financial service appears seamlessly inside the user experience.

For enterprises, this turns finance into a quiet engine that improves convenience for customers, reduces friction, and opens new revenue opportunities, all while staying behind the scenes.

⭐️ You may be interested in Digital transformation in banking

Why Embedded Finance Matters for Today’s Businesses

Embedded finance is becoming essential not because it’s trendy, but because powerful shifts in customer behavior, technology, and market dynamics are pushing businesses toward deeper financial integration.

Customer expectations for seamless digital experiences are rising

Modern users expect everything, payments, credit, payouts, verification, to happen instantly within a single platform. Any extra step, redirect, or delay feels outdated and causes drop-off. Businesses that cannot deliver smooth, in-platform financial experiences risk losing customers to competitors who can.

⭐️ Learn the key strategies and technologies that are redefining customer experience in the digital era

The shift toward platform-based business models

Enterprises are evolving into digital platforms rather than single-product companies. As ecosystems expand, embedded finance becomes the glue that connects services, partners, and users in one unified experience. Without it, platforms struggle to scale or monetize effectively.

Traditional financial systems are too slow and fragmented

Legacy banking infrastructure wasn’t built for today’s always-on digital operations. Processes like verification, payouts, lending, or reconciliation often involve manual steps, long waiting times, and disconnected tools. This creates friction that modern businesses can no longer afford.

Competitive pressure across industries

From retail to logistics to SaaS, companies are adding financial features to differentiate and capture more value. When competitors offer instant payments, flexible financing, or embedded insurance, customers start to expect the same everywhere, forcing others to follow suit.

⭐️ Explore how digital transformation is reshaping the retail sector

Advances in fintech infrastructure & API availability

Fintech enablers have made it dramatically easier for businesses to integrate financial services without becoming banks. Modern API-first platforms handle compliance, security, and licensing, allowing enterprises to innovate faster than ever.

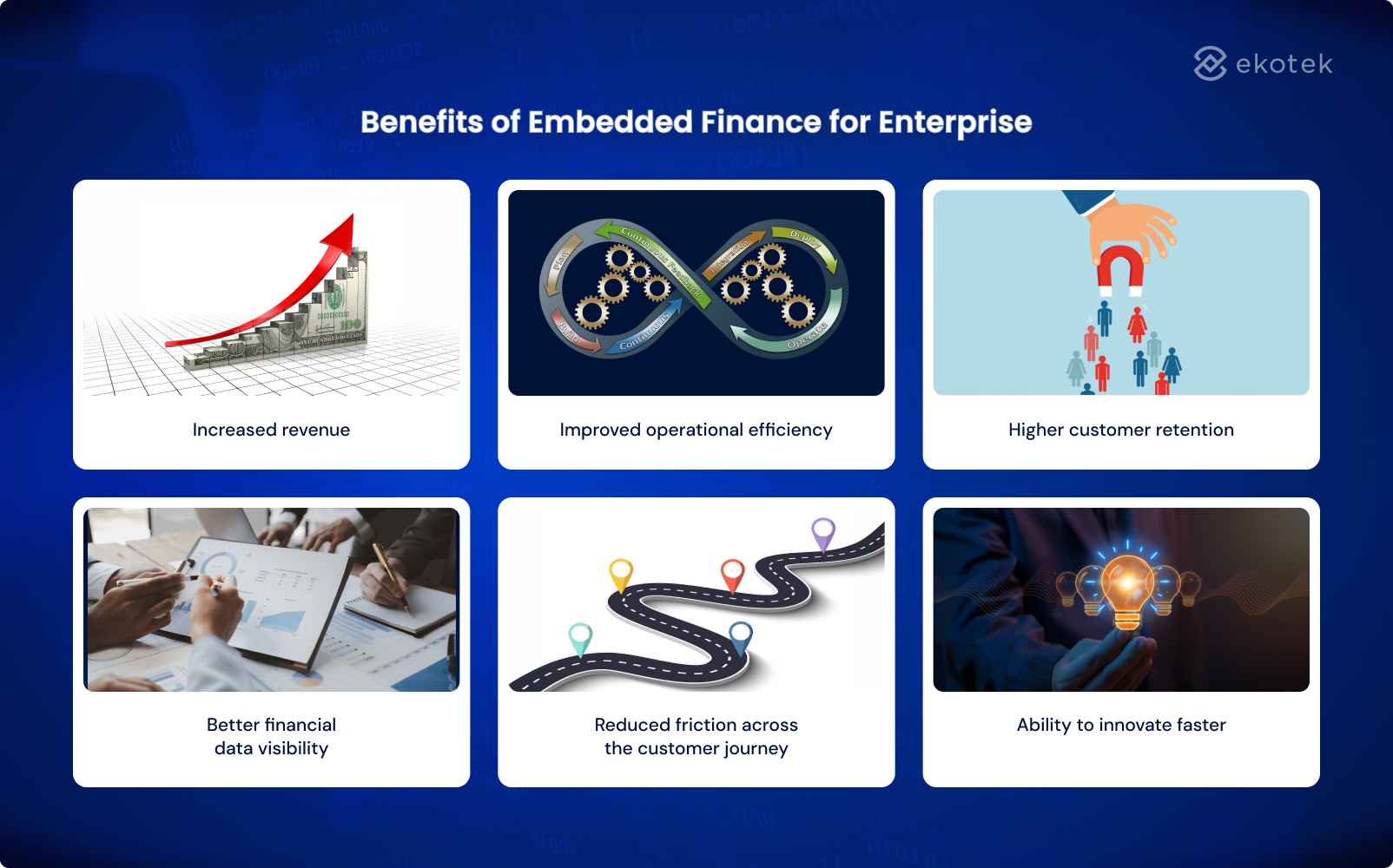

Benefits of Embedded Finance for Enterprise

Increased revenue and diversified income streams

By offering services like payments, financing, insurance, or wallets directly inside their platforms, enterprises can generate new revenue through fees, interest spreads, or value-added services. Instead of passing financial value to external banks, businesses capture it themselves.

Ekotek helped a payments provider build a modern payment infrastructure that integrates international networks like Visa and local e-wallets such as ShopeePay. By enabling merchants to accept a wider range of electronic payments across multiple countries, the client unlocked new transaction-based revenue streams and expanded into markets that were previously difficult to serve. This transformation turned payment processing from a cost center into a scalable source of recurring income.

⭐️ Contact Ekotek to explore how embedded payments can grow your revenue

Improved operational efficiency

Automated payouts, streamlined onboarding, integrated KYC, and real-time settlements reduce the manual work that traditionally slows teams down. Embedded finance eliminates multiple third-party systems and replaces them with smoother end-to-end workflows.

Higher customer retention & stronger loyalty

When customers can pay, borrow, insure, or transact without leaving the platform, they have fewer reasons to switch to competitors. Embedded finance creates a “stickier” experience where users stay longer and engage more frequently.

Ekotek partnered with a client to build a Web3 rewards platform that allows traditional businesses to offer crypto-based loyalty programs without needing blockchain expertise. The solution included a ready-to-use on-chain engine, wallet, rewards logic, token/NFT handling, and a quest-based engagement system, fully integratable with existing apps and CRM systems. This enabled businesses to launch modern, tokenized loyalty experiences quickly and securely, opening new ways to boost customer engagement and retention.

Better financial data visibility

With transactions happening inside one platform, enterprises gain clearer insights into customer behavior, cash flow, risk patterns, and operational performance. This data becomes a strategic asset for forecasting, personalization, and smarter decision-making.

Reduced friction across the customer journey

Every time a user is redirected to another website or app, the business risks losing them. Embedded finance removes those barriers, making checkout faster, onboarding easier, and financial interactions nearly invisible.

Ability to innovate faster

With API-driven financial capabilities, enterprises can quickly test, launch, and iterate new financial services without building infrastructure from scratch. This accelerates time-to-market and allows businesses to stay ahead of competitors and emerging customer needs.

How Embedded Finance Works

How Embedded Finance Works

The relationship between key participants

- The business (platform provider): The company integrating financial services into its product, responsible for the user experience and where financial actions appear.

- The financial infrastructure provider / fintech enabler: Supplies the APIs, workflows, and compliance-ready technology that power the financial features behind the scenes.

- The licensed financial institution: A regulated entity (often a bank) that holds funds, provides underwriting, and ensures all financial activities meet legal requirements.

⭐️ Read more about Fintech adoption in enterprises

API-first integrations

APIs act as the bridge that allows businesses to embed payments, lending, wallets, or identity verification directly into their platforms. This API-first approach makes financial actions happen instantly and keeps the user inside one seamless experience.

Compliance, KYC/AML, security layers

Embedded finance requires strict safeguards:

-

KYC verifies user identities

-

AML monitors and flags suspicious activities

-

Security controls (encryption, tokenization, authentication) protect data and transactions

Most of these layers are handled by the fintech enabler and the licensed institution, reducing the burden on the business.

Data flows and orchestration

When a user performs a financial action, data moves smoothly between the business, the fintech provider, and the licensed institution. The orchestration layer manages:

-

sending requests,

-

performing checks,

-

executing the financial transaction,

-

returning results in real time.

This behind-the-scenes coordination is what makes embedded finance feel instant and effortless to the end user.

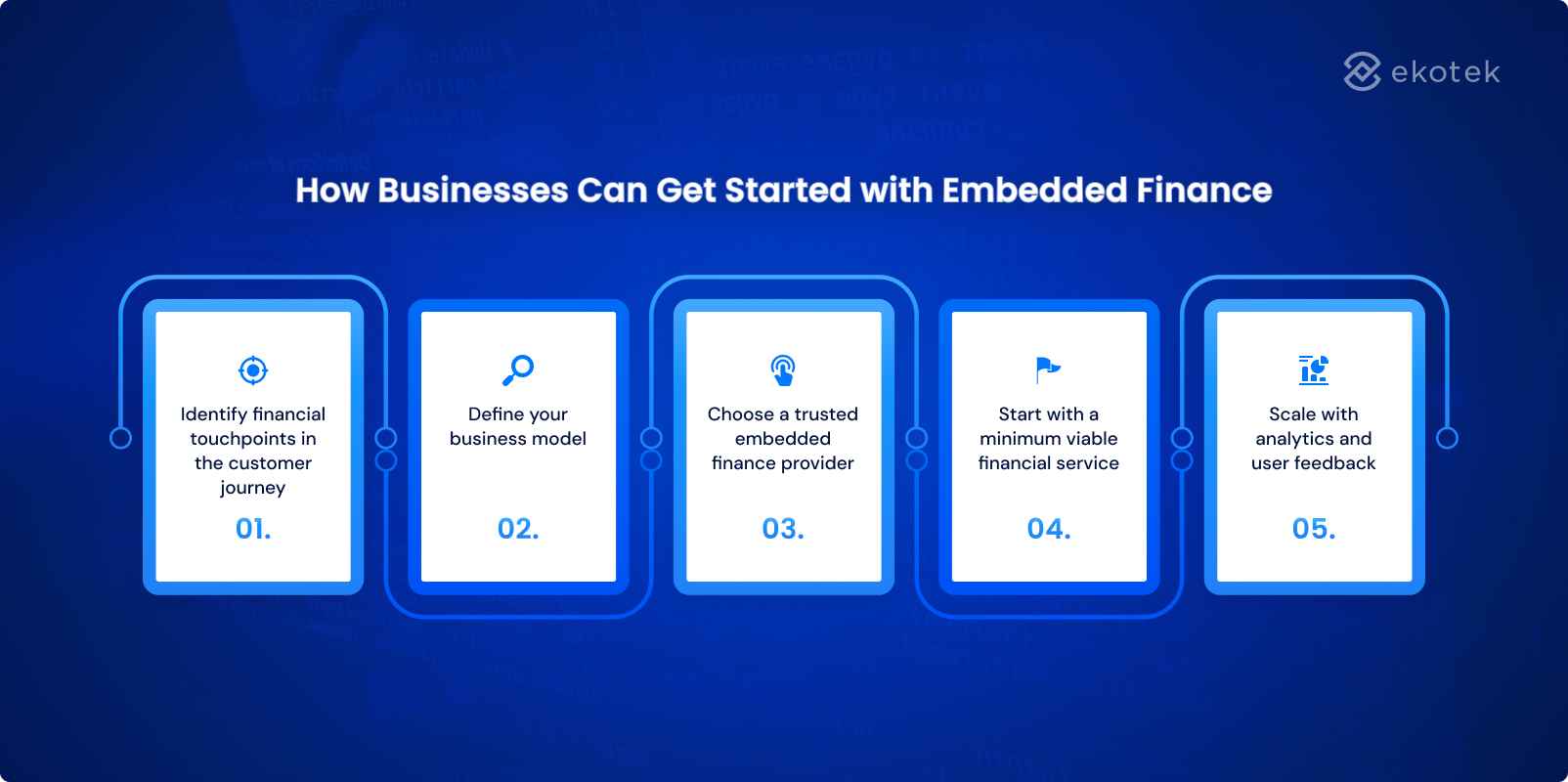

How Businesses Can Get Started with Embedded Finance

Identify financial touchpoints in the customer journey

Start by mapping where users naturally interact with money: payments, payouts, deposits, credit checks, insurance needs, subscriptions, or wallet balances. These moments reveal where embedded finance can remove friction or add value.

Define your business model and revenue opportunities

Consider how financial services could strengthen your offering:

-

Will you generate revenue from fees, interest spreads, or premium features?

-

Will embedded finance improve retention or customer lifetime value?

A clear business model helps prioritize which financial features to launch first.

Choose a trusted embedded finance provider

Select a fintech enabler that offers secure APIs, handles compliance, and has experience working with enterprises. Look for partners that can integrate smoothly with your existing systems and support future scaling.

⭐️ Explore how Ekotek can help your organization with our fintech services

Start with a minimum viable financial service

Instead of launching multiple features at once, begin with one high-impact service, such as instant payouts, BNPL, or a digital wallet. This reduces risk, speeds up deployment, and allows teams to learn from real user behavior.

Scale with analytics and user feedback

Track adoption, user satisfaction, transaction volume, and operational performance. Use these insights to optimize existing features and expand into new ones. Embedded finance works best when it evolves alongside customer needs and business goals.

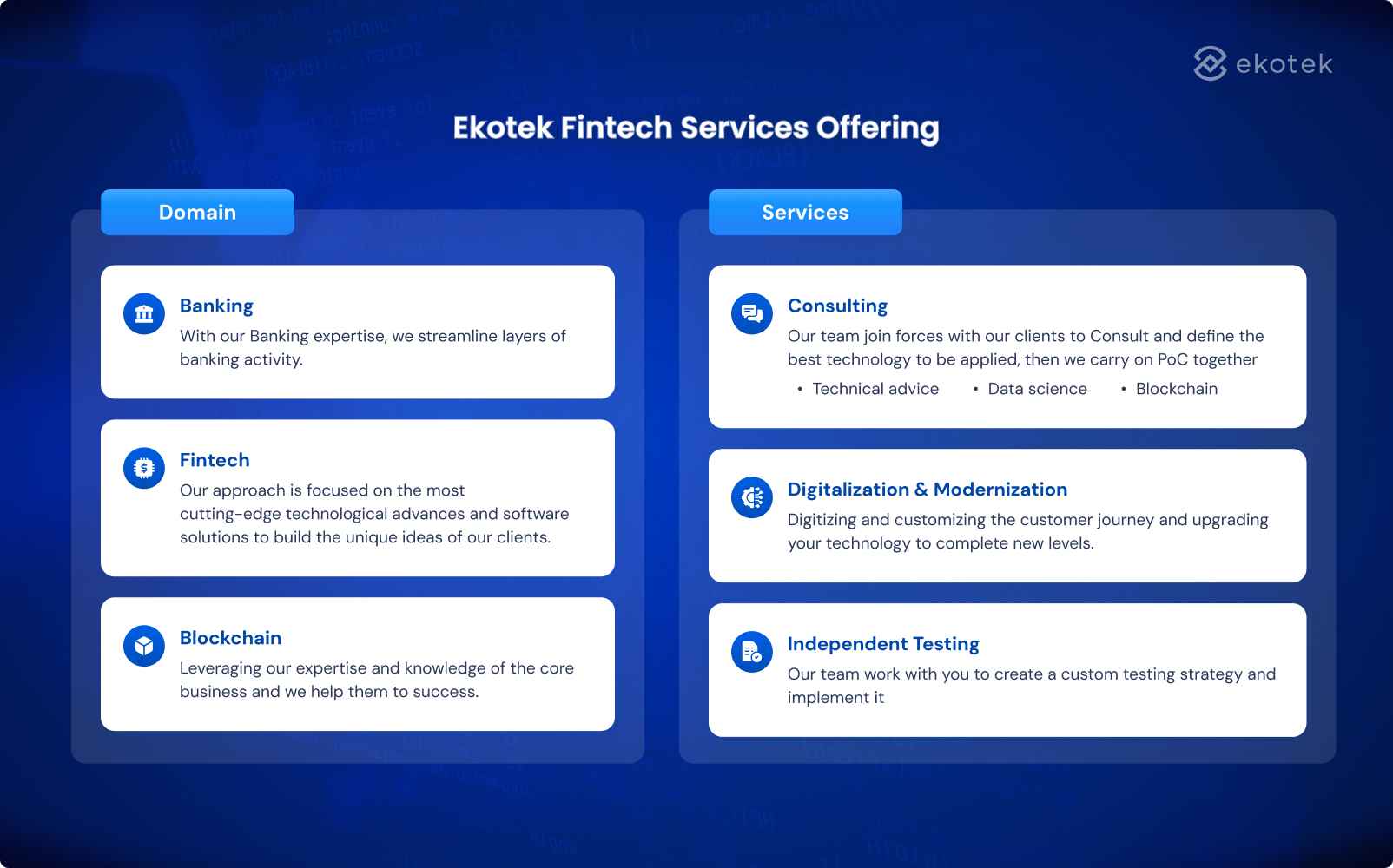

Ekotek Fintech Services Offering

Ekotek Fintech Services Offering

Ekotek supports enterprises on their embedded finance journey with a deep foundation in banking, fintech, and blockchain technologies, backed by a service model designed for complex, enterprise-level transformation.

Domain expertise across banking, fintech, and blockchain

Ekotek brings hands-on experience building lending systems, credit and risk engines, neo-banking platforms, payment and transaction solutions, and Web3/tokenization applications. This breadth allows us to design financial features that fit seamlessly into modern digital ecosystems.

Consulting to define the right transformation strategy

Our team works closely with business and technology leaders to identify opportunities, select the right financial technologies, and validate concepts through proof-of-concept development. We provide technical advisory, data science support, and blockchain expertise where needed.

Digitalization & modernization of enterprise platforms

Ekotek helps organizations upgrade legacy systems and customize the customer journey to support embedded finance capabilities. From architecture redesign to API enablement, we ensure platforms can scale securely and efficiently.

Independent testing for financial-grade reliability

Because trust is essential in financial services, we provide rigorous, independent testing to validate performance, security, and compliance. Our tailored testing strategies ensure new financial features launch with confidence and stability.

Conclusion

Conclusion

Embedded finance is reshaping how modern enterprises operate, turning financial interactions into seamless, in-platform experiences that drive revenue, strengthen loyalty, and streamline operations. As customer expectations rise and digital ecosystems become more interconnected, businesses that adopt embedded finance early will be far better positioned to innovate, differentiate, and scale.

For organizations exploring this transformation, choosing the right technology partner is essential. Ekotek brings deep domain expertise across banking, fintech, and blockchain, along with a refined workflow, rigorous quality control, and the ability to scale quickly for complex enterprise needs. Whether you’re modernizing core systems, integrating new financial features, or building end-to-end digital experiences, Ekotek can support you across the entire fintech service stack, from front-end interfaces to API integrations and core system orchestration.

Ready to turn embedded finance into a real competitive advantage

Ekotek is here to help you build it, securely, efficiently, and at scale

How Embedded Finance Works

How Embedded Finance Works Ekotek Fintech Services Offering

Ekotek Fintech Services Offering Conclusion

Conclusion