Empowering a newly launched centralized crypto exchange with a market-making bot

Empowering a newly launched centralized crypto exchange with a market-making bot

Deep liquidity via third-party exchanges

Automated order execution between accounts

산업

FinTech

배송

2 months

See how Ekotek helped bring a centralized cryptocurrency exchange to life with quick solutions to gradually enlarge the liquidity pool and stimulate trading activities, while keeping the platform monitored and the pricing stabilized.

Competition is fierce in the cryptocurrency market, particularly trading – there are nearly 600 exchange platforms worldwide at the start of 2023!

It is indeed a challenge for new platforms to gain awareness, trust, and ultimately transactions from the trader community.

That’s why a Japan-based DeFi startup with a freshly launched centralized exchange came to Ekotek for support: they need an innovative solution to significantly lift the platform liquidity pool, while also facilitating better trading experiences.

Upon receiving the request, our team of finance and blockchain specialists carefully researched the industry domain and analyzed the platform to propose the development of a market-making bot with two main functions as follows

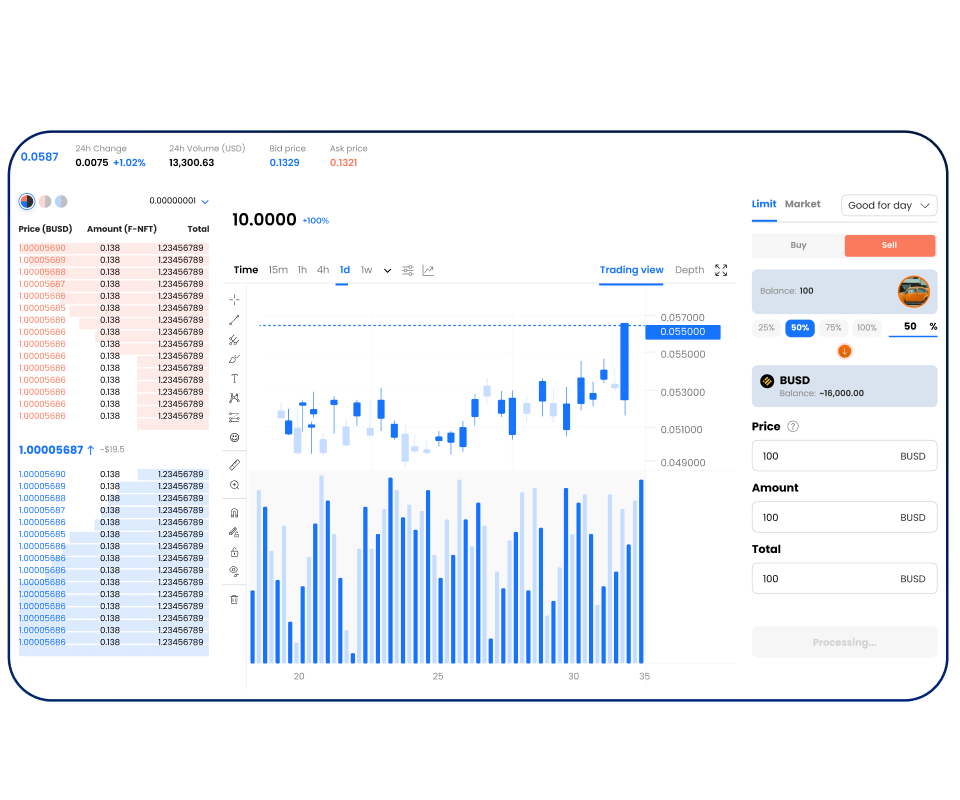

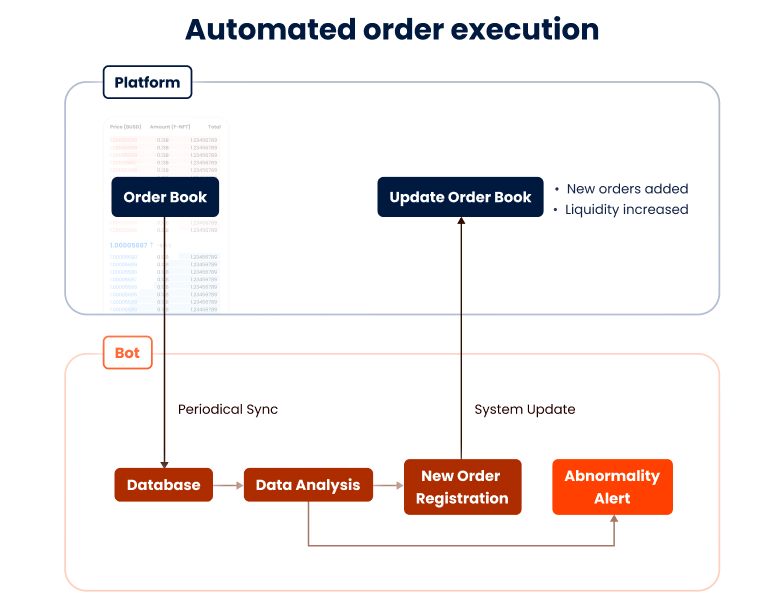

Automated order execution: The bot will sync orders from the centralized exchange’s order book, analyze them then execute natural orders between accounts that belong to the platform. Orders placed by the bot will then be processed by the platform and appeared in the live order book.

Liquidity provision: The bot integrates with various third-party exchanges to enhance the liquidity pool and reduce price slippage for platform users. Our smart algorithms will receive customer orders, then compare trading pairs on different exchanges to come up with the optimal rates.

Management-wise, admins can easily monitor the order book, make quick calculations and customize the algorithm for order placement according to demand. Additionally, parameters for abnormal activities, such as price fluctuation and high-value transactions, can be set so that admins can be notified every time such an event occurs.

The bot was agilely prototyped and built in just 2 months, followed by continuous tracking & optimization. After deployment, the crypto exchange recorded a 300% increase in trading volume and bid size orders, which fueled organic growth in traffic and registered users to the site.

The client was utterly satisfied as the final product was delivered and perfected within such a short time frame, by a full-service team with extensive experience in centralized and decentralized exchange platforms.

🔎 Looking for something similar? Explore our services

자신만의 성공 스토리를 시작할 준비가 되셨나요?